WI Nonprofit Tax Deductible Donations

Wisconsin residents are earning tax deductions by donating to qualified organizations like DogsInVests. As a tax-exempt, 501(c)(3) organization, everything donated to DogsInVests is considered charitable.

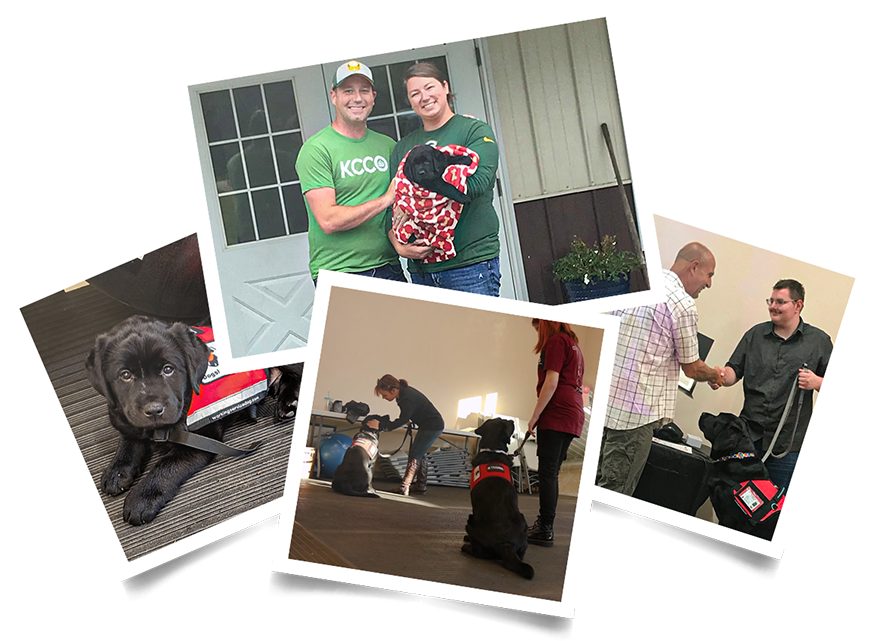

Our core mission is to support young people with autism – we achieve this goal by raising and training support dogs for that sole purpose. Once training is complete (generally after 12-18 months), our support dogs are paired with a child or young adult with autism in southeastern Wisconsin. The dogs, through their training, are able to recognize and respond to the symptoms of autism: overstimulation, feeling overwhelmed, and the display of harmful or repetitive behavior.

But it really all comes down to one thing. No matter who you are, having a trusted, four-legged companion by your side brings peace and comfort. That’s what we provide.